Guide: Changing to Historic Vehicle Tax Class By Post

- Tagged in collections:

- DVLA,

- Vehicle Excise Duty (VED)

The Problem

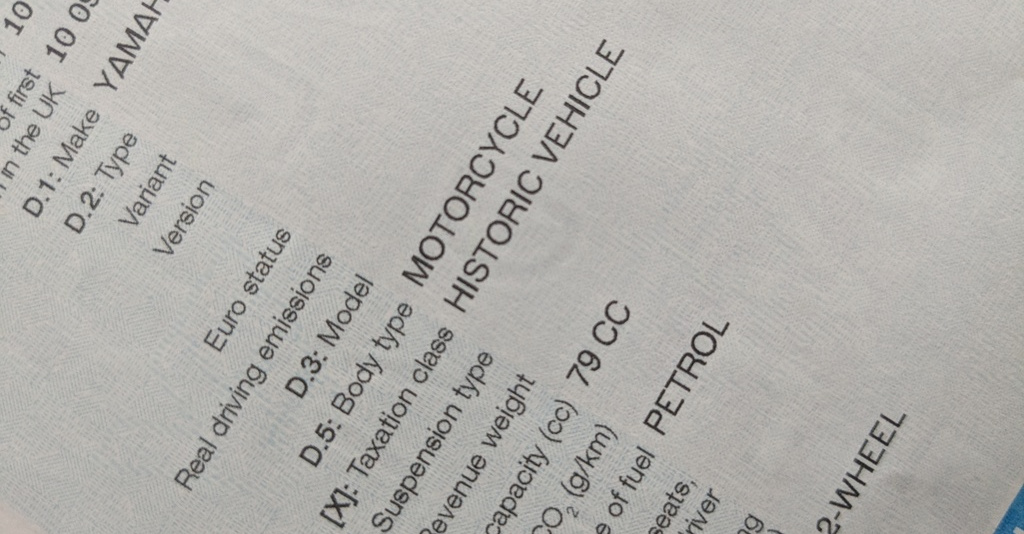

When a vehicle gets over 40 years old it becomes eligible to be classed as a Historic Vehicle (actually more like 41 years depending on what date it was registered, check the gov.uk website for eligibility dates). Once classed as historic, you get £0.00 road tax. You need to apply for it manually though and have the V5C updated.

According to the published guidance, you can only do this at a Post Office counter. However, many Post Offices have no clue how to do this - I have had one lose my V5C entirely (costing me £25 to replace), and another flat out say that historic tax could not be done at a Post Office! So, I set out to find a way to do it by post, so I could deal directly with DVLA and cut out the Post Office entirely.

It's essentially using the old licensing team, which the DVLA info now prefers to keep quiet about, preferring you to use their online or Post Office systems. The team now only seem to be advertised for edge cases like post-dated tax for those going abroad, trade plates, emergency service vehicles, and other oddities. Anyone who has dealt with bureaucracy knows that these are the best sort of teams, because the back-office experts are always kept away from the public!

This way of applying is not documented on the gov.uk guidance, but it works. I have taxed two mopeds recently using this method, with both getting taxed and receiving new V5Cs within about a week.

The Solution

You will need to send to them:

-

Your V5C Registration Certificate (log book) or the green new keeper slip. I'm assuming that you've got this already, but if not then guidance on applying for a V5C registration document is here.

-

Form V10 (click to download) (Application for Vehicle Tax). Enter all the obvious bits, then enter "Historic Vehicle" in the "Tax class you are applying for" box, tick "12 months" for "How long do you want the tax to run for?", and backdate the start date to the first day of the current month.

-

Form V112 (click to download) (Declaration of exemption from MOT) to use the 40 year MOT exemption, or a copy of your current MOT if you prefer (or do not qualify for exemption due to substantial modifications). If your vehicle is a heavy goods vehicle, you may need form V112G instead, see notes on form V112 for more info.

-

Only if your vehicle is registered to an address in NORTHERN IRELAND: include a copy of your insurance. See notes on form V10 for more info.

Send all those forms in a single envelope to:

DVLA

Swansea

SA99 1DZ

That's all there is to it. Once processed, the tax status will be updated to taxed (check online), and you will get a new V5C in the post. For future years, you can simply tax as normal (online, post etc.) at £0.00 cost.

A Note on Insurance

As mentioned above, you don't need insurance to do this paperwork (unless you are in N. Ireland). However! By applying for tax and getting tax, your vehicle is now taxed. This may seem obvious, but the upshot is that if a vehicle is taxed, it MUST be insured. So, after you successfully get the V5C back, you need to then get insurance as it is now taxed, or you must SORN it and take it off the road. If you don't do either, after a month or so you will get a very snotty letter from the Motor Insurance Bureau telling you that you are going to get in trouble.

Footnote: to head off the pedants, yes it's called Vehicle Excise Duty (VED) not road tax, we all know what I mean.

- Tagged in collections:

- DVLA,

- Vehicle Excise Duty (VED)